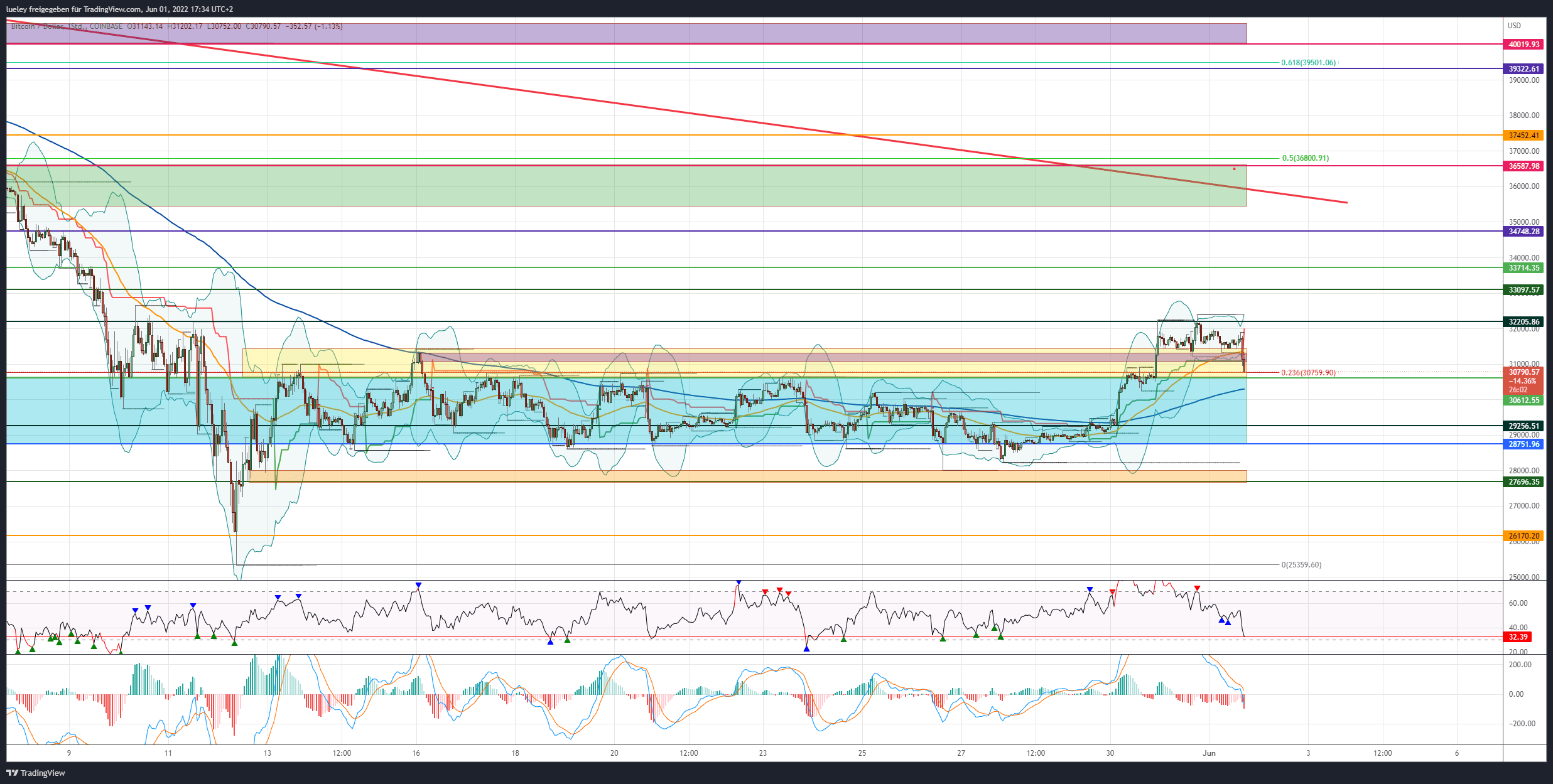

BTC Rate: $30,790 (Previous day: $31,300)

Short-term resistance/goals: 31,200/31,422 USD, 32,205/32,383 USD, 33,097 USD, 33,714 USD, 34,748 USD,35,650 USD, 36,587 USD, 37,452 USD, 38,250 USD, 39,322 USD,39,854 USD,40,019 USD, 40,851 USD, 41,183 USD,

Short-term support: $30,612, $30,210, $29,256, $28,751, $28,005, $27,696, $26,170, $25,342, $23,887, $21,892, $19,884

Price analysis based on the value pair BTC/USD on Coinbase

Recap Bitcoin:

- The crypto market joined the recovery on the classic financial market in the last trading days and was able to break out of its sideways range upwards at the start of the week, as assumed in the last price analysis.

- With this, a first directional decision seems to have been made.

- If the bulls manage to stabilize the BTC price above $ 30,612 in the coming days, it is planned in the short term with a renewed increase in the direction of strong resistance at $ 32,205. So far, however, the buyer camp Bitcoin has not been able to stabilize above this resistance mark at the hourly closing price.

- That even the Fear & Greed Indexwhich reflects the fear and greed of investors, has increased in recent days from a value of 10 to currently 17, can also be assessed positively. The investors now see an entry into Bitcoin as a little less dangerous.

- Unchanged“ the “Golden Pocket” at $ 26,170 is to be regarded as the overriding key support. As long as Bitcoin is trading above this support at the close of the day, a further price decline towards USD 20,000 is unlikely.

- The reversal movements of several listed US crypto companies are also positive. The Great Bitcoin Miner Marathon Digital Holdings has recovered significantly from its annual low in the last seven trading days and has meanwhile increased by more than 26 percent to the north. Also the largest listed crypto exchange in the US, Coinbase, increased in value by a remarkable 100 percent in the last two trading weeks. This development indicates, at least in the short term, a possible end to the sell-off of the last trading months.

Another price weakness imaginable at any time

- However, if the Nasdaq100 cannot continue its recovery rally, Bitcoin should not be able to escape a renewed price consolidation.

- Because despite all the euphoria, the year 2022 marks Bitcoin’s weakest start to the year since 2018. Nine red weekly candles in a row speak a clear language.

- True, the technical indicators of Bitcoin already in recent weeks indicated a possible technical recovery movement. However, how sustainable this trend is will become apparent in the coming trading weeks.

- The short-term bear market rally is at least partly due to short liquidations and short coverages in the future market, which is why investors should not panic now.

- Since the Nasdaq100 has also now reached a strong resistance area and is trending significantly south in the last few hours of trading, renewed price declines are conceivable at any time.

Bullish Scenario (BTC):

- The buyer side initially managed to avert a further decline below the $ 28,000 in the last seven trading days. As a result, Bitcoin turned up significantly at the start of the week and broke out of its sideways phase upwards.

- The BTC price rose to a new 14-day high at $ 32,383, but could not sustainably break through the resistance at $ 32,205. The short-term recovery goal has thus been achieved.

- Currently, Bitcoin is again in the range of $ 30,900 and thus slightly below the last significant historical high at $ 31,422.

- However, in order not to jeopardize the current trend movement, investors must necessarily stabilize the BTC price above the $ 31,200 (supertrend), but at least avert a relapse back into the range of the last trading weeks. In particular, the $ 30,612 mark is worth paying increased attention here.

- If Bitcoin can confirm the break out of the range in the coming days, this would be another indication for higher prices to start in the range of $ 35,000.

- If Bitcoin promptly skips the resistance mark at $ 32,205 and forms a new historical high, a march up to $ 33,097 is to be planned.

- If the 33,097 USD is also breached at the end of the hour without significant price resets, further price targets will activate at 33,714 USD and in particular 34,748 USD. Thus, the first important goal in the form of the price gap of the future course is the Chicago Mercantile Exchange (CME) within reach. This also “GAP” the quoted price gap is between $ 34,470 and $ 35,650. Not infrequently, after a so-called “GAP-close”, there is an increase in profit taking.

The trend movement continues

- Should the BTC price continue to stabilize despite short-term profit realizations in the future, an increase to the upper edge of the green resistance zone at $ 36,587 is also conceivable. Not far above this is the medium-term price target, which has been mentioned several times, at 37,452 USD.

- Thus, Bitcoin would have also overcome the red higher-level downtrend line, currently at around $ 36,000.

- Unchanged, the tear-off edge at $37,452 represents the make-or-break price level for the coming trading weeks.

- Only when Bitcoin can also recapture the $ 37,500, the bulls will target the next overarching price target at $ 39,322.

- In addition to a strong horizontal resistance line, the 61 Fibonacci retracement of the higher-level downward movement also runs here.

- Unchanged, the range between $ 39,322 and $ 40,019 represents the maximum bullish price target of the relief movement.

Bearish Scenario (BTC):

- The bears are currently trying to initiate a countermovement and sell Bitcoin back below the 31,200 USD in the direction of the upper edge of the range at 30,612 USD.

- If it is possible to push the BTC price back below the 30.612 USD at the end of the hour, this would be a first bearish indication.

- Just below that, the EMA200 (blue) is waiting for further support at $ 30,200. Already here, the bulls are likely to try again to stabilize the BTC price.

- If Bitcoin slips back under these supports in a timely manner, there is a false outbreak on the top side in the room. If it falls back below the psychologically important $ 30,000 mark, the price weakness is likely to increase and push Bitcoin back towards the $ 29,256 mark.

- A direct retest of the 28.751 USD would also be conceivable. If BTC slips below this price level at the end of the hour without significant resistance, the next relevant supports at $ 28,005 (pre-week low) and $ 27,696 will become the focus of investors.

- At $ 27,696, there is a cross support consisting of horizontal support and 61 Fibonacci retracement of the last price movement.

Further course fees are likely

- If Bitcoin also breaks through these price levels dynamically, a correction extension up to the 26,170 USD can be expected.

- This support mark represents the last potential reversal level on the way to the annual low at $25,342.

- Thus, the probability of a further trend movement to the south, including the formation of new annual low rates, increases noticeably.

- If Bitcoin slips below the psychologically important $ 25,000 mark, the next price target on the downside activates at $ 23,887.

- Even a direct relapse up to the 21.892 USD cannot be ruled out.

- If the global financial markets also trend further south in the coming trading months, Bitcoin should also continue to decline up to the 20,000 USD.

- Unchanged, this psychologically important price mark represents the maximum bearish price target for the coming months.

Disclaimer: The price estimates presented on this page do not constitute buy or sell recommendations. They are just an analyst’s assessment.

The chart images were created with the help of TradingView created.

USD/EUR rate at the time of writing: 0.94 Euro.

You want to buy cryptocurrencies?

eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet user-friendly platform.